When discussing the greats of trading history, few names resonate as powerfully as Jesse Livermore. Known as one of the most successful speculative traders of all time, Jesse Livermore’s career continues to inspire modern investors and day traders alike. His ability to navigate volatile markets and turn chaos into opportunity remains a benchmark for aspiring traders.

But who was Jesse Livermore, and why does his legacy still influence the financial markets today? In this comprehensive article, we will delve into his life, trading strategies, impact on modern markets, and the valuable lessons he left behind.

Who Was Jesse Livermore?

Born in 1877, Jesse Lauriston Livermore began his trading career at just 14 years old. Starting out as a boy on the ticker board at a Boston stock brokerage firm, the young boy quickly developed an uncanny ability to predict stock price movements by observing market patterns. By the age of 16, he had made over $1,000—a significant sum at the time—and quit his job to pursue trading full-time.

Jesse Livermore’s rise to fame was not linear. Like many traders, he experienced spectacular highs and devastating lows. Despite these setbacks, his name remains synonymous with speculative trading success. His journey from humble beginnings to becoming one of Wall Street’s most renowned traders is a testament to his skill and resilience.

The 1929 Stock Market Crash: Livermore’s Finest Hour

Jesse Livermore’s most remarkable achievement came during the Wall Street Crash of 1929. While millions of Americans lost their life savings in the economic downturn, Jesse Livermore foresaw the collapse and took significant short positions in the market.

His bold moves earned him over $100 million at the time (equivalent to over $1.5 billion today). This fortune solidified his reputation as the “Boy Plunger,” a nickname he earned for his aggressive trading style and willingness to take calculated risks. Jesse Livermore’s success during this period made him a household name and a legend in the financial world.

Jesse Livermore’s Trading Strategies and Philosophy

Jesse Livermore’s trading strategies were based on a combination of technical analysis, market psychology, and risk management. His approach to trading focused on:

1. Trend Analysis

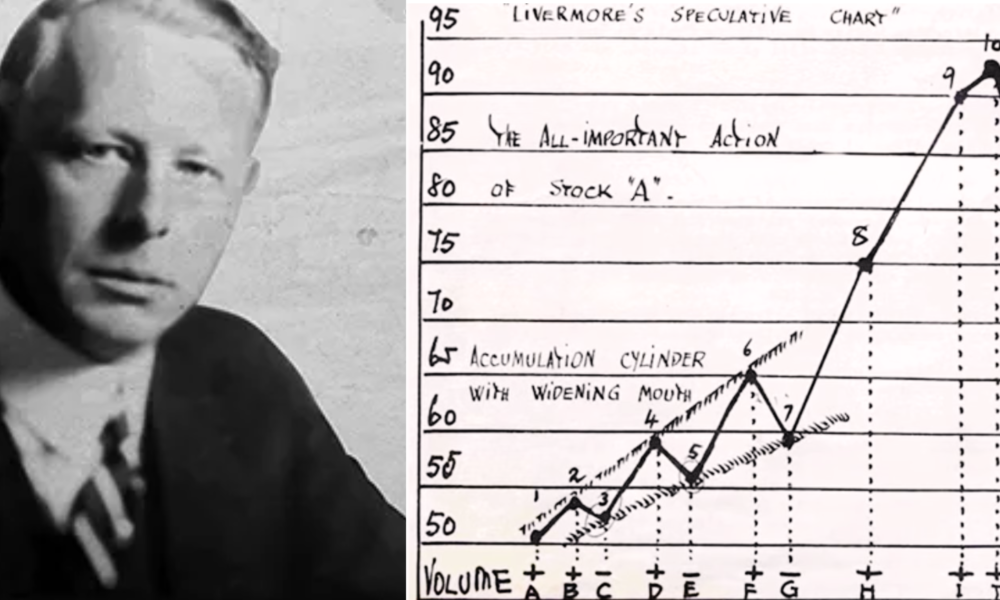

Livermore believed in following the market’s trends rather than fighting them. He developed a keen ability to identify major market movements and capitalize on them. His philosophy of “the path of least resistance” remains a key principle in trend trading today.

2. Risk Management

One of Livermore’s golden rules was cutting losses quickly. He emphasized the importance of protecting capital and avoiding large drawdowns. His mantra, “Only take trades when conditions are favorable,” still serves as a cornerstone of modern trading strategies.

3. Market Timing and Patience

Jesse Livermore often waited for the “right moment” to enter or exit trades, emphasizing that timing is everything. He understood that impatience could lead to poor decision-making and unnecessary losses. His disciplined approach serves as a lesson for traders looking to navigate volatile markets successfully.

4. Understanding Market Psychology

Jesse Livermore recognized that fear and greed drive market behavior. He meticulously studied crowd psychology and used it to his advantage. His ability to anticipate market sentiment helped him make some of the most profitable trades in history.

How Jesse Livermore’s Strategies Influence Modern Traders

Technical Analysis and Market Patterns

Jesse Livermore was a pioneer in recognizing recurring market patterns. Modern traders use his methods as the basis for technical analysis tools, such as moving averages, support and resistance levels, and breakout strategies.

Psychology of Trading

Jesse Livermore understood that emotions drive market behavior. His belief that fear and greed shape stock prices is echoed in today’s trading psychology principles. Books and courses on trading psychology still reference his insights to help traders manage their emotions and make rational decisions.

Risk Management

The saying “Don’t fight the tape” comes directly from Livermore’s philosophy. His emphasis on aligning with market trends and managing risk influences hedge funds and retail traders alike. Stop-loss orders, position sizing, and capital preservation strategies all have roots in his teachings.

Jesse Livermore’s Lessons for Aspiring Traders

For those inspired by Jesse Livermore’s legacy, here are some actionable tips to apply his principles today:

1. “How to Use Market Trends for Successful Day Trading”

Jesse Livermore’s trend-following strategy teaches traders to wait for confirmation before committing capital. Identifying and trading with the prevailing trend increases the probability of success.

2. “The Importance of Risk Management in Stock Trading”

Jesse Livermore’s golden rule of cutting losses fast remains critical for financial success. Setting stop-loss orders and managing risk-to-reward ratios are essential for long-term profitability.

3. “Stock Market Psychology: Lessons from Livermore’s Trading Career”

Understanding the emotional aspects of trading helps avoid common pitfalls. Recognizing when fear or greed is driving decisions can prevent costly mistakes.

Jesse Livermore’s Downfall: A Cautionary Tale

Despite his immense success, Jesse Livermore’s life was marked by dramatic financial swings. He made and lost several fortunes throughout his career. His story serves as both an inspiration and a warning about the dangers of excessive risk-taking and emotional trading.

Jesse Livermore’s final years were plagued by financial troubles and personal struggles. He ultimately took his own life in 1940. His tragic end underscores the importance of financial discipline and emotional resilience in trading.

A Lasting Impact on Wall Street

Jesse Livermore’s life serves as both a cautionary tale and a source of inspiration. While his financial success was unparalleled, his personal struggles highlight the importance of balancing ambition with well-being.

Modern traders studying Livermore’s strategies gain timeless insights into market behavior, risk management, and emotional discipline. His influence on trading philosophy ensures that his legacy continues to shape Wall Street and global financial markets.

Even today, Jesse Livermore’s teachings remain relevant. His book, Reminiscences of a Stock Operator, continues to be a must-read for traders and investors. His ability to master market trends, manage risks, and understand human psychology makes him one of the most important figures in financial history.

Conclusion: The Enduring Legacy of Jesse Livermore

Jesse Livermore’s story is one of extraordinary talent, ambition, and volatility. His trading methods, risk management principles, and psychological insights have influenced generations of investors. By studying Jesse Livermore’s successes and failures, traders can improve their own approach to the markets.

Whether you are a day trader, a long-term investor, or someone interested in financial history, Livermore’s legacy offers invaluable lessons. His contributions to market analysis and speculation continue to shape the way we understand and navigate financial markets today.

If you are looking to sharpen your trading skills, understanding the principles that guided Jesse Livermore could be the key to success. His name, synonymous with both triumph and tragedy, remains a cornerstone of Wall Street legend. And for those willing to learn from his experiences, his legacy provides a roadmap to mastering the art of trading.