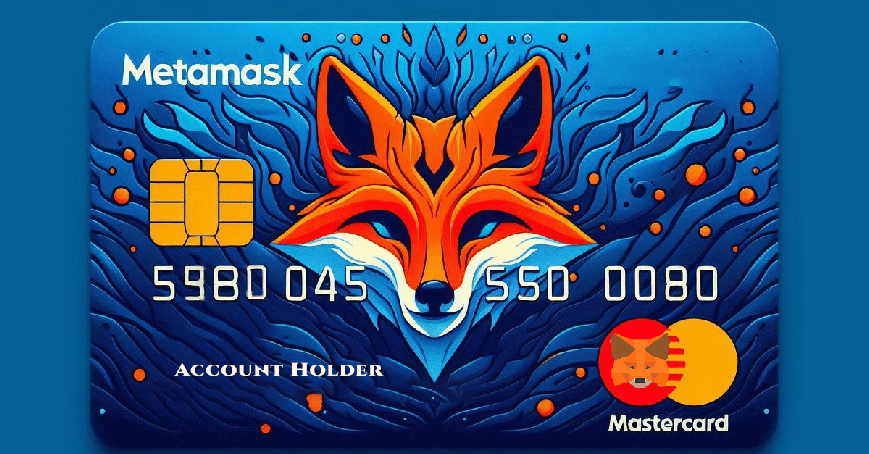

MetaMask, in partnership with Mastercard and Baanx, recently launched the MetaMask Card. This innovation represents a major breakthrough, allowing users to make everyday purchases directly with cryptocurrencies using the MetaMask wallet. The announcement, made last Wednesday by ConsenSys, the company behind MetaMask, marks a major shift in the way we use cryptocurrencies in our daily lives. The MetaMask Card is a powerful tool designed to simplify cryptocurrency payments by bridging the gap between traditional financial systems and blockchain technology.

As the popularity of cryptocurrencies continues to rise, it’s clear that their adoption will expand beyond investment and trading. With the introduction of the MetaMask Card, MetaMask and Mastercard are working together to make using cryptocurrencies for everyday transactions both easier and more practical. Now, individuals can access their digital assets and use them as they would any traditional currency, opening the door for mass adoption.

How the MetaMask Card Overcomes Transaction Barriers

Historically, using cryptocurrencies for everyday transactions has been cumbersome. Users would often need to convert their digital assets into fiat currency via an exchange before they could make purchases. This process involved multiple steps: transferring crypto to an exchange, converting it to cash, and then transferring the funds to a bank account. For many, this made cryptocurrencies impractical for routine purchases.

With the MetaMask and Mastercard collaboration, the MetaMask Card removes these barriers, enabling users to directly spend their cryptocurrencies stored in MetaMask wherever Mastercard is accepted. This breakthrough eliminates the need for exchanges and the delay associated with currency conversions. Whether buying groceries or making online purchases, the MetaMask and Mastercard partnership simplifies the entire process. For crypto enthusiasts, this means greater freedom and flexibility, as they can now use their assets instantly without undergoing the traditional financial hoops.

Additionally, the MetaMask Card allows users to maintain control over their assets. The cryptocurrency is still stored in their MetaMask wallet, and transactions occur directly from it, avoiding the risks associated with holding funds on an exchange. This solution significantly reduces friction, making cryptocurrency transactions as simple and straightforward as using a credit or debit card.

Easy Cryptocurrency Purchases with the MetaMask Card

The MetaMask and Mastercard collaboration introduces a new era of cryptocurrency transactions. One of the most significant advantages of the MetaMask Card is its ability to make purchasing with cryptocurrencies just as easy as with traditional money. Users no longer have to deal with the complexities of converting digital currency to fiat money. This convenience is especially important for individuals who already use MetaMask for their cryptocurrency storage and transactions.

By linking directly to a user’s MetaMask wallet, the card provides seamless integration with cryptocurrency networks. The ability to spend crypto directly from MetaMask makes this tool incredibly efficient. Users simply select the cryptocurrency they wish to use, and the MetaMask Card processes the transaction in real-time, converting the assets into the required format to complete the purchase.

For many, this represents a profound shift in how they interact with their crypto holdings. No longer relegated to trading and speculation, cryptocurrencies are becoming a legitimate means of exchange in the global marketplace. The MetaMask and Mastercard partnership has thus broken new ground, making crypto transactions accessible to a much wider audience.

Initial Support and Web3 Integration

The MetaMask Card is initially compatible with three major cryptocurrencies: USDC, USDT, and WETH. These digital assets are based on the Linea network, a blockchain designed to facilitate secure and quick transactions, particularly in Web3 environments. The MetaMask and Mastercard collaboration is essential for this Web3 integration, as it ensures that crypto assets can flow smoothly between decentralized applications (dApps) and traditional merchant systems.

This integration of Web3 and Web2 is vital for the adoption of cryptocurrencies in the real world. It creates an ecosystem where decentralized assets can be used in centralized financial systems, reducing the friction typically found between these two worlds. Web3 represents the future of the internet, and by incorporating it into the payment structure through the MetaMask Card, MetaMask and Mastercard are positioning themselves at the forefront of this revolution.

The Linea network, chosen for its speed and reliability, ensures that every transaction made using the MetaMask Card is processed quickly and securely. This move towards a seamless Web3 experience is pivotal in demonstrating that cryptocurrencies can be just as practical and reliable as traditional currencies, if not more so.

Reducing Barriers Between Blockchain and Traditional Payments

Lorenzo Santos, Senior Product Manager at ConsenSys, emphasized that the MetaMask Card is a key player in reducing the barriers between blockchain technology and traditional payment systems. MetaMask and Mastercard have collaborated to develop a solution that not only simplifies crypto usage but also promotes the acceptance of digital currencies in everyday life.

By providing a card that can be used anywhere Mastercard is accepted, the MetaMask and Mastercard partnership is driving the adoption of blockchain technology in mainstream financial services. This is a crucial step in normalizing cryptocurrency and removing the complex barriers that have previously hindered its broader use. With the MetaMask Card, consumers can now use their cryptocurrencies like any other form of payment, making digital assets more accessible than ever before.

The move towards interoperability between blockchain and traditional financial networks could be the catalyst needed to accelerate mass adoption of cryptocurrencies. With the MetaMask Card, MetaMask and Mastercard are helping to bridge this gap and demonstrate the utility of digital currencies in daily financial activities.

Security and Speed Benefits

When it comes to cryptocurrency transactions, security and speed are paramount. The MetaMask Card addresses both concerns. Transactions are processed swiftly, thanks to the Linea network, ensuring that users experience little to no delay when making payments. Additionally, the card retains the security features of the MetaMask wallet, which uses state-of-the-art encryption and multi-layer security to safeguard users’ assets.

The MetaMask and Mastercard partnership ensures that all transactions made with the MetaMask Card are secure, minimizing the risk of fraud or loss of funds. The immediate control users maintain over their assets throughout the transaction adds an extra layer of protection. Unlike traditional payment systems, which often require third parties to handle funds, the MetaMask Card ensures that users’ crypto holdings remain within their control, allowing for a safer and more efficient transaction experience.

Security is a key concern for those using cryptocurrencies, and MetaMask and Mastercard have prioritized this aspect in the development of the card. Whether for large purchases or everyday transactions, users can rest assured that their digital assets are protected.

MetaMask Card’s Goal: Security and Interoperability

Raj Dhamodharan, executive vice president of Mastercard, explained that the goal of the collaboration between MetaMask, Mastercard, and Baanx is to provide an ecosystem that is not only secure but also interoperable. “We identified a significant opportunity to make purchases easier, safer, and more interoperable for these users,” said Dhamodharan. This vision is central to the mission of MetaMask and Mastercard: to simplify the way we use cryptocurrencies and integrate them seamlessly with the traditional financial world.

This partnership aims to provide a universal payment solution, where users can access and use their cryptocurrency holdings with the same ease as they do traditional currencies. It also strives to ensure that users can transition between different systems—whether blockchain-based or fiat-based—without the hassle of conversions or complex steps.

By focusing on interoperability, MetaMask and Mastercard are creating a future where digital currencies can become an integral part of everyday transactions. This goal could eventually lead to a world where cryptocurrencies are accepted globally, and digital wallets like MetaMask become as common as bank accounts.

MetaMask Card Expansion and Impact on Financial Accessibility

Currently in the pilot phase, the MetaMask Card is only available in the European Union and the United Kingdom. However, the partnership between MetaMask and Mastercard has big plans for expansion, with plans to roll out the card to other regions in the near future. This expansion is crucial for making cryptocurrencies more accessible to a global audience.

One of the most exciting prospects of the MetaMask Card is its potential to improve financial accessibility, especially for those in regions with large populations of unbanked individuals. Simon Jones, Chief Commercial Officer at Baanx, noted that the card could provide essential financial services to people who may not have access to traditional banking systems. “Anyone with access to a mobile phone should have access to basic financial services,” Jones said.

Through the MetaMask Card, MetaMask and Mastercard aim to provide financial inclusion for people who have been excluded from the traditional banking system. This could significantly reduce economic inequality, as it opens up opportunities for individuals who have previously faced financial exclusion.

Conclusion: The Future of Cryptocurrency Transactions and the MetaMask Card

The MetaMask and Mastercard partnership represents a major leap forward in the integration of cryptocurrencies with traditional financial systems. The MetaMask Card is set to transform the way we make payments, allowing for seamless, secure, and rapid transactions. By reducing barriers and enhancing accessibility, this partnership is shaping the future of financial transactions.

As MetaMask and Mastercard continue to expand the use of the MetaMask Card, it’s clear that this innovation could play a significant role in the global adoption of cryptocurrencies. Whether it’s simplifying purchases, increasing financial inclusion, or promoting greater security, the MetaMask Card is leading the way in making cryptocurrencies a practical tool for everyday life.