Richard Dennis is an iconic name in the world of finance and investments. Known as the “Prince of the Pit,” Dennis is an American trader who rose to prominence in the 1970s and 1980s, turning an initial loan of just $1,600 into a fortune estimated at over $200 million in a decade. His unique trading strategy and the famous “Turtle Experiment” left an indelible mark on the history of finance. This article explores the journey of Richard Dennis, his revolutionary contributions, and the lasting impact of his strategies on modern trading.

The Journey of a Trading Genius

Richard J. Dennis was born in 1949 in Chicago, Illinois. Raised in a middle-class family, Dennis developed an early interest in finance and economics. At 17, he began as a runner at the Chicago Mercantile Exchange (CME), marking his first step into the high-stakes world of futures trading. This intense environment honed his skills and set him on the path to becoming one of the most successful traders in American financial history.

Dennis later earned a degree in Philosophy from DePaul University in Chicago, where he developed his analytical and strategic thinking. His entry into the markets, however, was practical and straightforward. With a loan of $1,600, he launched his futures trading career, displaying an extraordinary ability to anticipate market movements and trends. His story serves as a prime example of how knowledge, discipline, and risk management can lead to success in financial markets.

Rising in the U.S. Futures Market

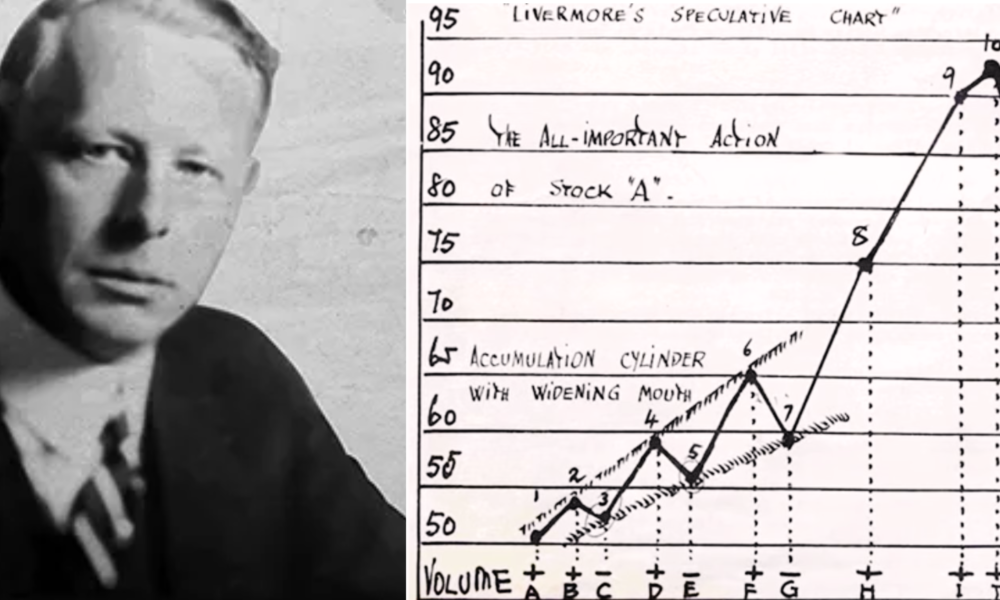

By the 1970s, Richard Dennis had quickly become a legend in the American futures market, applying a disciplined and systematic approach based on technical analysis. Unlike many traders who relied on intuition or insider knowledge, Dennis believed in a rule-based methodology that could be taught and replicated. This approach led him to develop one of the most successful trading systems in history.

Dennis firmly believed that anyone could learn to trade successfully if they followed a set of simple rules and maintained the necessary discipline. This revolutionary belief drew attention from many, as Dennis not only amassed a fortune but also demonstrated an impressive knack for predicting market trends.

His strategic and calculated approach stood out as something truly innovative. In fact, it proved that success in U.S. futures trading is not simply a matter of luck. Rather, it depends on having a solid strategy, along with the discipline to execute it consistently.

One of Dennis’s key contributions to the trading world was his emphasis on trend following. He believed that markets move in trends and that by identifying and capitalizing on these trends, traders could achieve consistent success. This philosophy became the cornerstone of his trading strategy, allowing him to accumulate significant wealth in a relatively short period.

The “Turtle Experiment” and the Famous Wager

In 1983, Richard Dennis decided to prove that anyone could become a successful trader if they followed clear rules. He made a bet with his business partner, William Eckhardt, on the importance of training and education in a trader’s success. This wager led to the famous “Turtle Experiment.”

Dennis recruited people from diverse backgrounds, including many who had no prior trading experience, and then taught them his rigorous strategies. These students, known as the “Turtles,” followed a specific set of rules regarding entry and exit points, risk management, and position sizing. The results of the experiment were astonishing—the “Turtles” generated millions in profits, proving Dennis’s theory that trading success could be systematically taught and replicated.

The “Turtle Experiment” became one of the most famous trading experiments in history, solidifying Richard Dennis’s reputation as a visionary trader and educator. His systematic approach laid the foundation for modern quantitative trading strategies and continues to influence traders and financial analysts worldwide.

Richard Dennis’s Trading Philosophy

At the core of Richard Dennis’s success was his unwavering belief in systematic trading. He emphasized the following key principles:

- Trend Following: Dennis believed that markets move in trends and that traders should follow these trends rather than attempting to predict reversals.

- Risk Management: He taught that successful trading requires strict risk management, including limiting losses and letting profits run.

- Position Sizing: He advocated for adjusting trade sizes based on market volatility and overall portfolio risk.

- Emotional Discipline: Dennis stressed the importance of removing emotions from trading decisions, relying instead on predefined rules and strategies.

- Replicability: He proved that trading could be taught and that success was not limited to a select few with innate talent.

These principles have since become fundamental in modern trading education and are widely used by hedge funds, proprietary trading firms, and individual investors.

The Challenges and Controversies

Despite his immense success, Richard Dennis faced several challenges throughout his career. By the late 1980s, market conditions had shifted, and his trading strategy encountered difficulties. A series of losses during the stock market crash of 1987 led Dennis to step away from active trading. However, his influence did not wane. His methodologies continued to be studied and applied by traders worldwide.

Dennis also faced criticism from skeptics who argued that his success was due more to favorable market conditions than to a replicable strategy. However, the long-term success of many of his “Turtles” dispelled these doubts, proving that disciplined rule-based trading could yield consistent profits.

The Lasting Legacy of Richard Dennis in Modern Trading

Richard Dennis’s impact on the financial world goes beyond his personal wealth. His belief that anyone could achieve trading success by following disciplined rules transformed the teaching and practice of trading. The “Turtle Experiment” remains a classic case study and is widely discussed in business schools and in books on trading and market psychology.

His influence is evident in the rise of algorithmic and systematic trading. Many modern hedge funds and proprietary trading firms employ principles derived from Dennis’s work, including trend-following strategies and quantitative analysis.

Dennis’s approach emphasizes the importance of a resilient mindset, risk management, and discipline. For many, he exemplifies how financial success is achievable through well-structured strategies and a commitment to continual learning. His legacy also serves as an inspiration to aspiring traders who seek to navigate the complexities of financial markets with a systematic approach.